1. Work out how much you can afford to spend

You'll need to save up a deposit, you might be lucky enough to get some help towards your deposit with a gift from your parents. You'll need a mortgage illustration from your lender to show how much they might be willing to lend you (this stage of the mortgage application process is not credit checked).

Chapter two of the book includes calculations for working out your maximum budget.

2. Find a house and make a winning offer

House hunting is the fun bit, but it can be heart breaking to find your dream home and have your offer rejected. Chapter 2 includes tips for finding your house, and our tried and tested formula for getting your offer accepted.

3. Instruct a Solicitor

This can actually be done before you make your offer, which may help you get it accepted. Having a communicative solicitor makes every difference to your home buying experience which is why at SAM we assign you a dedicated conveyancing executive to case handle your purchase. Chapter 3 contains all you need to know when choosing a solicitor and what you'll need to provide them with to get things underway.

4. Apply for your mortgage (the lender will value the property)

A mortgage broker is so helpful when choosing the right product and making your application, Chapter 4 covers tips on improving your credit score and submitting your application.

The lender will have a valuation conducted to be sure that the property is worth the money they are lending, Chapter 2 includes a section explaining what you can do if the lender undervalues the property.

5. Conduct Surveys & Searches

We would never recommend anyone buy a house without having a survey. You'll need to choose between a Level 2 or Level 3 survey, (unless it a new build, in which case you'll want a snagging survey) our team will happily talk you through these options. Your conveyancing searches are normally ordered by your solicitor on your behalf. Your SAM Conveyancing quote will include the standard search bundle. Your solicitor will recommend any additional searches appropriate for your specific property.

6. Your solicitor conducts legal enquiries

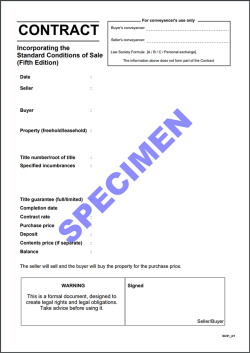

The seller's solicitor sends over a draft contract pack for your solicitor to review. Your solicitor reviews all of the documents for any legal concerns and then raises enquires that the seller and their solicitor must answer. In order to complete their legal enquiries, your solicitor will also need your ID/Proof of Funds/Formal instruction documents, Mortgage Offer, Property Searches and Survey (if ordered).

If your solicitor finds there are defects with the property or queries which can't be resolved, they can help you negotiate a better price with the seller. In some cases it may be advisable to pull out of the sale all together.

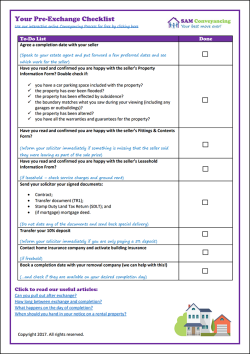

7. Exchange Contracts

When the terms of the purchase have been agreed, you and the seller sign the contracts, legally binding you to complete the transaction (if you don't there are penalties). You'll also sign the TR1 Transfer Form, Stamp Duty Land Tax Form (SDLT) & Mortgage deed (if applicable). You will now be responsible for insuring the building (unless you're buying a leasehold).

8. Completion

To make sure you complete on time, it can help to transfer your completion monies the day before. your solicitor collects your mortgage funds (if you're using one) and your completion monies, then sends the full purchase amount to the seller's solicitor. Then the sellers solicitor release's the keys and you can collect them from the estate agent. Make sure you get all your keys, check the property is empty, check the meter readings and inform the utilities company(ies) of the change of ownership.

9. Post Completion.

Time to move in! Your solicitor files your Stamp Duty Land Tax form and pays any tax due. If the property is leasehold, they will obtain notice from the freeholder or their management agent. Finally they'll make an application to register your ownership at the Land Registry.

How to Buy a House without killing anyone looks into each of these stages in depth, with tips and guidance along the way, for handling all of the involved parties, overcoming common obstacles and speeding up the process, plus added extras including email templates to handle common roadblocks.