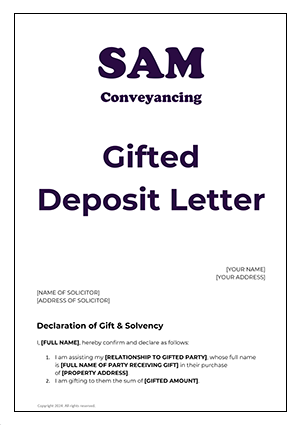

Gifted Deposit Letter

Your mortgage lender requires a gifted deposit letter during the conveyancing process if you are obtaining a gift from your parents or a friend. The reason for the letter is so that the mortgage lender can prove that the money is a gift and not in fact a repayable loan. The document is also known as a deed of gift.

The gift letter for mortgage should be completed and provided to the conveyancing solicitor along with the gifter's proof of ID, address and proof of funds. We explain in this article here - How to prove source of funds.

Is this a gifted deposit letter?

Dear Sir/Madam,

The money we paid to our son is a gift.

Kind regards.

Mum and Dad

All too often, parents or friends gift money, email something similar to the solicitor as their declaration that the deposit is a gift. Sadly, when the solicitors receive these emails, they invariably tell the children to inform the parents. A simple statement like this isn’t sufficient for the mortgage lender; the parents have to send the information in the correct format.

Download a gifted deposit letter template, free from hassle.

- Instant download

- Easy to fill in

- Suitable for mortgage lenders

- Sign, witness and gift the money

The templates will be attached to your confirmation email after payment. Please allow a couple of minutes for the email to arrive.

£5 INC VAT

a solicitor

need for a

Gifted Deposit?

By Andrew Boast, CEO of SAM Conveyancing

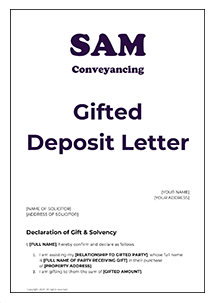

7 stages of a Gifted Deposit Letter?

- 1Who, relationship and address

The parties declare the full name of the person giving and receiving the gift, their relationship to them and the purpose

For example: We are assisting our daughter, whose full name is Kirstie Smith, in their purchase of 41 An Example Road, B4 1NE.

- 2Gift amount

The parties declare the gift amount, and this should include all money being gifted toward the purchase, including the gifted deposit and purchase costs.

For example:We are gifting her £25,000.

- 3The reason for the gift

The parties declare the reason why they are gifting the money. For parents gifting money to their children, this is normally out of love and affection or a duty to help them buy their first home. This is very common. What is less common, is for a friend to gift money to you, as there isn't a normal reason to gift a large sum of money and not expect to get this repaid at some point in the future.

For example: We understand that by gifting the sum to her, that our action is a gift of love and affection.

- 4The gift is not repayable

The parties declare that the money is a gift and is not repayable. This declaration ensures that the money cannot be called upon in the future, because it now belongs to the home buyer.

For example: We declare that the gifted deposit is unconditional, non-repayable and does not give us any rights over the property and will not prejudice the security of their Mortgage Company, Nationwide Building Society.

How do you ensure your gift isn't shared with the partner?

If you are a parent gifting money to a son or daughter and you don't want their partner to make a claim on the deposit, then you can:

- state in your gift letter that it is a gift just to your son or daughter; and

- the buyers can get a Deed of Trust to confirm how much the joint owners individually own in the property. The deed would protect the money invested in the property if the relationship breaks down.

- 5You are solvent

The parties declare that they are solvent. The reason for this is that if the parties are made bankrupt up to 5 years after the gift, then the administrator could force a sale of the property to repay the debts. We explain this in more detail in our article on - Insolvency Act Rules.

For example: We hereby confirm that at the date of this Declaration we are solvent, our assets exceed our liabilities and we have no reason to believe that we will become bankrupt.

- 6Independent Legal Advice

The parties declare that they understand the solicitor acting for the buyers doesn't provide them with any legal advice. The independent legal advice would be to explain the implications of gifting large sums of money and to confirm if they can financially afford this.

For example: We hereby confirm that we are aware that your solicitor cannot provide us with any legal advice in this matter and we have been advised by your solicitor to obtain independent legal and financial advice before proceeding further.

- 7Signed and witnessed

The gifted deposit letter is signed by the parties in front of witnesses who, in turn, sign the letter. The witness cannot be a family member or someone who benefits from the transaction. A friend, neighbour or work colleague is fine to use. If you are overseas, then the witness should be the notary public or solicitor used to verify your ID.

Are your children buying a home using a gifted deposit?

We don't charge any extra if they are receiving a gifted deposit to help pay for their home, unlike so many other conveyancing solicitor firms. In addition to that, the purchase will be protected by our No Sale, No Fee Policy.

Andrew started his career in 2000 working within conveyancing solicitor firms and grew hands-on knowledge of a wide variety of conveyancing challenges and solutions. After helping in excess of 50,000 clients in his career, he uses all this experience within his article writing for SAM, mainstream media and his self published book How to Buy a House Without Killing Anyone.

Caragh is an excellent writer and copy editor of books, news articles and editorials. She has written extensively for SAM for a variety of conveyancing, survey, property law and mortgage-related articles.