Should I Remortgage to Pay off Equity Loan?

Help to Buy homeowners are facing a dilemma: remortgage to pay off their equity loan or keep it with increasing interest? The right choice depends on interest rates and personal financial circumstances.

Property price growth forecast

The average UK house price will increase by over 21% by 2028, with an annual growth of around 4-5% between 2025 and 2028.

It's important to note that the equity loan value will increase if property prices increase.

Remortgaging your Help to Buy property to repay the equity loan eliminates future interest payments and allows you to retain the full value appreciation of your home. It may be a good option if the new mortgage rate is lower than the equity loan interest rate combined with the original mortgage.

However, if the homeowner doesn't repay until selling the property, they must repay the government's portion of the property (up to 20% of the sale value). This will reduce the net profit from the sale.

Benefits of remortgaging

Lower monthly repayments

By combining the mortgage and equity loan into a single monthly outgoing, homeowners can often get a more favourable interest rate and reduce their overall monthly expenses. With lower monthly outgoings, money could be allocated towards paying off the mortgage more quickly.

Potential for a fixed-rate mortgage

This means that the interest rate on the mortgage remains the same for a set period, typically between two and five years. This can offer stability and protection against future interest rate rises. After which, you can switch to the next best deal available.

Is it difficult to remortgage a Help to Buy property?

Some lenders may require you to pay off the equity loan before allowing you to remortgage with them. Since you're not obligated to repay the equity loan until the end of its term (usually 25 years) or the property is sold, this might not be ideal for you.

If you have enough savings, you can pay off the equity loan early. This will reduce your loan-to-value ratio, potentially leading to better remortgage deals.

While borrowing additional funds against your home means taking on a larger mortgage, it also ensures that your property is fully yours, allowing you to benefit from any future appreciation in value.

Help to Buy specialists

SAM's panel of conveyancing solicitors are experts in Help to Buy transactions and will help with your remortgage process to completion.

Take advantage of our fixed fees and the fact we're on 99% of mortgage lender panels. Property challenges solved.

Costs of remortgaging

Remortgaging fees

- Valuation fees: A surveyor will need to assess the property's value to determine the amount you can borrow. This might set you back around £500. We offer this service from £250 EXC VAT.

- Legal fees: A solicitor handles the legal paperwork associated with the remortgage. Fees vary depending on the complexity of the transaction, but will likely range from £500 to £1,500. Our costs for this start from £347.

- Arrangement fees: Charged by the lender to cover the costs of setting up the new mortgage. These vary widely between lenders and their policies.

Higher interest rates

The interest rate on the new mortgage might be higher than the interest rate on the equity loan. This is especially likely if the homeowner has a poor credit history or a high debt-to-income ratio.

A homeowner paying a 2% fixed mortgage rate might be offered a new mortgage with a 3.5% interest rate, significantly increasing their overall monthly payments.

SAM's Help to Buy Repayment Calculator

Check out our Help to Buy Repayment Calculator which estimates your monthly interest payments for your equity loan.

Your Help to Buy mortgage payments differ from the Help to Buy equity loan repayments. You can use our calculator to estimate the interest repayments, but we also have a mortgage payments calculator available.

Why would you be refused a mortgage?

A remortgage application can be denied for various reasons, including bad credit or negative equity. If one lender has rejected you, there may be other lenders willing to approve your application. Be wary of making too many applications in quick succession - it's best to wait around 6 months or so before making another mortgage application.

Book a FREE(i) consultation with one of our independent brokers.

- Access to the whole market.

- Not tied down to selling any particular lender's products.

- 100% impartial advice.

- No need for face-to-face meeting.

Top tips for remortgaging to pay off an equity loan

- Long-term financial goals: Think about your future plans, such as buying another property or retiring. Remortgaging could impact your ability to achieve these goals.

- Risk tolerance assessment: Consider your comfort level with financial risk. Remortgaging involves taking on a new mortgage, exposing you to potential interest rate fluctuations.

- Current mortgage terms: If your existing mortgage has a low interest rate and favourable terms, it may not be worth remortgaging unless the potential benefits significantly outweigh the costs. However, be prepared to pay interest on the equity loan from year 6.

- Property's potential value: If you believe your property value is likely to increase significantly in the future, it might be worth repaying the loan before it increases. By remortgaging, you fix the debt as the value is now rather than potentially paying more later./li>

Comparing interest rates

Several factors can influence interest rates, including:

- The overall state of the economy, including inflation and interest rate trends.

- Different lenders may have varying interest rate policies based on their risk assessment and business goals.

- The borrower's credit history, income, and debt-to-income ratio can significantly impact the interest rate offered.

- Longer loan terms often come with higher interest rates.

- Interest rates may vary based on the location of the property.

- The amount you're borrowing compared to the property's value can influence the interest rate (LTV Ratio).

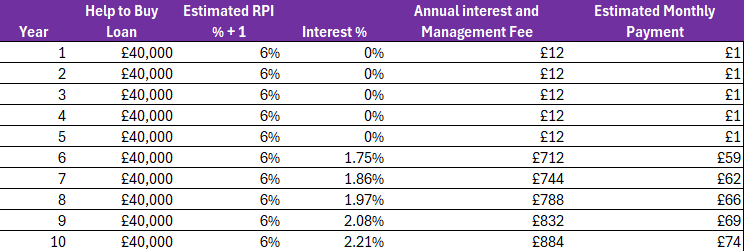

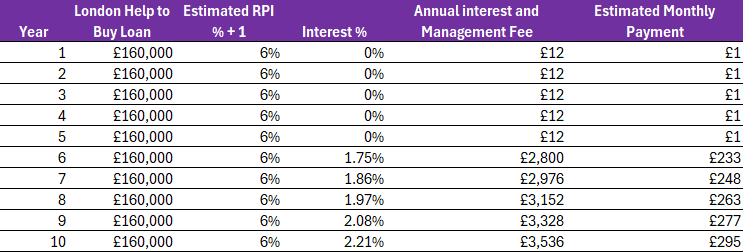

Help to Buy equity loan interest rate

The interest rate on the equity loan is fixed for the first five years. This means that the interest rate remains the same throughout that term, providing stability for homeowners.

However, from year 6, interest on the equity loan is payable. It's calculated by adding the Consumer Price Index (CPI) plus 2% (or Retail Price Index (RPI) plus 1% for loans taken out between 2013 and 2021) to the initial rate of 1.75%.

Given that interest fee payments begin in year 6, it's worth examining the impact of this additional monthly expense alongside main mortgage repayments.

These interest and management fee payments do not contribute towards equity loan repayments. The full debt will still be repayable upon sale.

Mortgage interest rates

Mortgage interest rates can be either fixed or variable. A fixed-rate mortgage means the interest rate remains the same for a set period, typically between two and five years. A variable-rate mortgage means that the interest rate can fluctuate based on changes in the market.

When comparing interest rates from different lenders, consider the following:

- Annual Percentage Rate (APR): This accounts for the interest rate and any additional fees associated with the loan.

- Fixed vs. Variable Rates: Decide whether you prefer a fixed rate for stability or a variable rate for potentially lower initial rates.

- Some lenders may charge fees for early repayment of the loan.

- Compare fees such as arrangement fees, valuation fees, and legal fees.

- Consider the lender's reputation for customer service and responsiveness.

Thinking of moving home?

You can't port your equity loan to another property. You can remortgage the current property to pay off the loan in full or in part, or you'll have to repay the loan in full if you sell, even if you're getting a new mortgage on the next property

Case studies

Note: These case studies are based on an RPI (Retail Price Index) of 5% + 1% and property prices increasing by 4% each year.

10-Year-Old Equity Loan

- Homeowner: Sarah

- Property Value: £350,000

- Equity Loan Amount: £70,000

- Remaining Terms: 15 years

- Current Mortgage Interest Rate: 4%

- Current Equity Loan Interest Rate: 2.21%

- Monthly Management Fee: £1

Sarah has been paying interest on her equity loan for 5 years. Her current interest rate is 2.21%, higher than the initial rate in year 6 of 1.75%. If Sarah remortgages to pay off the equity loan today, she may be financially better off since the interest rate won't be a factor anymore. Here's how:

If Sarah manages to secure a new mortgage rate at 4.7%, the total interest she will pay on the equity loan value via the mortgage will be £3,290.

However, if she chooses to continue paying interest on the loan, the total interest she would need to pay is £1,604. Therefore, the amount of interest payable if remortgaging is higher by £1,686 (£3,290 - £1,604).

If Sarah does not remortgage this year, the amount she owes on the equity loan will increase by £2,800 next year (based on the property value increasing by 4%).

Overall, this means Sarah will be financially better off by £1,114 if she remortgages to pay off her equity loan in year 10.

£1,604 for continuing interest payments + the £2,800 increase in the amount owed - £3,290 (amount to pay off the equity loan through remortgaging).

8-Year-Old Equity Loan

- Homeowner: David

- Property Value: £400,000

- Equity Loan Amount: £80,000

- Remaining Terms: 17 years

- Current Mortgage Interest Rate: 3.5%

- Current Equity Loan Interest Rate: 1.97%

- Monthly Management Fee: £1

David has been paying interest on his equity loan for 3 years. His current interest rate is 1.97%, higher than the initial rate in year 6 of 1.75%.

Remortgaging to pay off the equity loan could result in David being better off financially. Here's how:

If David manages to secure a new mortgage rate at 4.7%, the total interest he pays on the equity loan value via the mortgage will be £3,760.

However, if he chooses to continue paying interest on the loan, the total interest he would need to pay is £1,634. Therefore, the amount of interest payable if remortgaging is higher by £2,126 (£3,760 - £1,634).

If David does not remortgage this year, the amount owed on the equity loan will increase by £3,200 next year (based on the property value increasing by 4%).

Overall, this means David will be financially better off by £1,074 if he remortgages to pay off the equity loan in year 8.

£1,634 for continuing interest payments + the £3,200 increase in the amount owed - £3,760 (amount to pay off the equity loan through remortgaging).

5-Year-Old Equity Loan

- Homeowner: Emily

- Property Value: £280,000

- Equity Loan Amount: £56,000

- Remaining Terms: 20 years

- Current Mortgage Interest Rate: 3%

- Current Equity Loan Interest Rate: 0% (since the loan is less than 6 years old)

- Monthly Management Fee: £1

Emily is not paying interest on her equity loan as it is less than 6 years old. Once the loan reaches year 6, she will pay interest at 1.75%, increasing yearly.

Emily could remortgage to pay off the equity loan early and avoid future interest payments, but she might be better off financially. Here's how:

If Emily secures a new mortgage rate at 4.7%, the total interest she pays on the equity loan value via the mortgage will be £2,632.

However, if she chooses to start paying interest on the loan from year 6, the total interest she would need to pay is £1,016. Therefore, the amount of interest payable if remortgaging is higher by £1,616 (£2,632 - £1,016).

If Emily does not remortgage this year, the amount owed on the equity loan will increase by £2,240 next year (based on the property value increasing by 4%).

Overall, this means Emily will be financially better off by £624 if she remortgages to pay off the equity loan in year 5.

£1,016 for continuing interest payments + the £2,240 increase in the amount owed - £2,632 (amount to pay off the equity loan through remortgaging).

Note that these are just examples, and individual circumstances may vary.

- Fixed, competitive legal fees with no hidden costs.

- Expert conveyancing solicitors with proven local knowledge.

- No Sale, No Fee protection for your transaction. Terms apply.

- On 99% of mortgage lender panels.

- Fast completions.

- We can solve any property challenge.

Jack is our resident Content Writer with a wealth of experience in Marketing, Content, and Film. If you need anything written or proof-read at a rapid speed and high quality, he's your guy.

Caragh is an excellent writer and copy editor of books, news articles and editorials. She has written extensively for SAM for a variety of conveyancing, survey, property law and mortgage-related articles.