Can I pull out after exchange of contracts?

- Notice to complete legal fee of the other side's solicitor

- Interest

- Penalties under the contract - these differ from seller to buyer.

What can go wrong between exchange and completion?

The risk of either the seller or buyer pulling out are incredibly low, however here are a few examples of what can go wrong between exchange and completion:- either the buyer or seller changes their mind;

- either the buyer or seller was committing a criminal offence;

- the buyer's mortgage offer is pulled or expires and they are unable to secure further finance (this was high risk during COVID and the October 2022 mortgage crisis); or

- death.

The penalties under the contract of exchange

Buyer pulls out after exchange | Seller pulls out after exchange |

|---|---|

Buyer pulls out after exchange 7.4 Buyer's failure to comply with notice to complete 7.4.1 If the buyer fails to complete in accordance with a notice to complete, the following terms apply. 7.5.2 The seller may rescind the contract, and if he does so: (a) he may: (i) forfeit and keep any deposit and accrued interest (ii) resell the property and any contents included in the contract (iii) claim damages (b) the buyer is to return any documents he received from the seller and is to cancel any registration of the contract. 7.4.3 The seller retains his other rights and remedies. | Seller pulls out after exchange 7.5 Seller's failure to comply with notice to complete 7.5.1 If the seller fails to complete in accordance with a notice to complete, the following terms apply. 7.5.2 The buyer may rescind the contract, and if he does so: (a) the deposit is to be repaid to the buyer with accrued interest (b) the buyer is to return any documents he received from the seller and is, at the seller's expense, to cancel any registration of the contract. 7.5.3 The buyer retains his other rights and remedies. |

What is the process to pull out after exchange of contracts?

- 1

Because of the risk of either party pulling out, it is best not to give the buyer access before completion.

Need help pulling out of a purchase contract?

We have specially trained solicitors on hand to help you if you need to pull out after exchange of contracts. If you need help with your exchange contract please email us at help@samconveyancing.co.uk providing the following information:- Your full name and contact number;

- Copy of your exchange contract;

- Confirmation of your reason for pulling out; and

- Any further evidence to support your case.

Upon receipt we will get in contact and provide a quote for the work required. Alternatively, you can call us at 0333 344 3234 (local call rate) or get in touch using the form below:

Example of if a buyer pulls out after exchange:

Here is an example if a buyer pulls out after exchange purchasing a £500,000 property:- Loses 10% deposit of £50,000

- Pays interest of 4% above Bank of England base rate of £770.54 (£450,000 * 6.25% / 365 x 10 days)

- Sellers legal fees of £1,500

In this example it has cost the buyer to pull out after completion £52,270.54.

Andrew started his career in 2000 working within conveyancing solicitor firms and grew hands-on knowledge of a wide variety of conveyancing challenges and solutions. After helping in excess of 50,000 clients in his career, he uses all this experience within his article writing for SAM, mainstream media and his self published book How to Buy a House Without Killing Anyone.

Caragh is an excellent writer and copy editor of books, news articles and editorials. She has written extensively for SAM for a variety of conveyancing, survey, property law and mortgage-related articles.

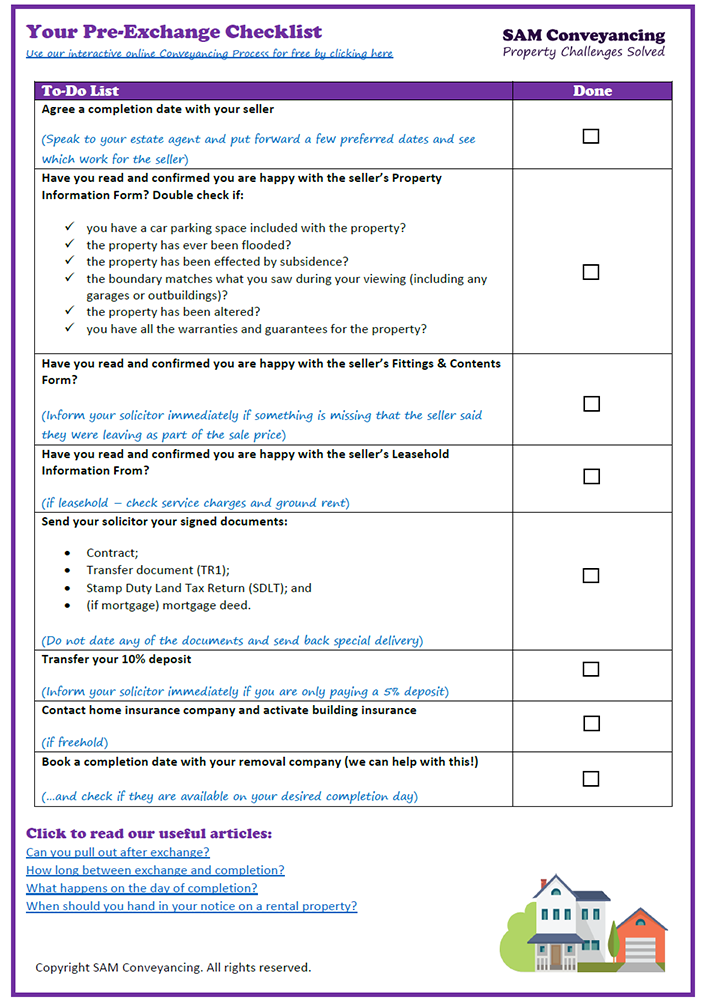

- online checklists

- videos

- free downloads

- useful tips