How long between exchange and completion?

- You can have as long as you like between exchange and completion, as long or short as the chain agrees.

- Common choices are 3 days, 1-2 weeks, or 1-3 months.

- A same-day exchange and completion should be avoided.

- You may not have a choice of a completion date if there is a new build in the chain with completion on notice.

How long between exchange and completion can be any time, mutually agreed between all parties in the chain, although 2 weeks is usually the standard. Most buyers want to exchange and complete on the same day, which is possible but not advisable. We explain the pros and cons for how long the time should be between you exchanging and completing - quite often, it comes down to what is logistically possible rather than anything else.

A Property Chain is the term used for all of the buyers and sellers connected via various sale and purchase conveyancing transactions; it most often has a first-time buyer at one end and someone selling a home without buying one somewhere else at the other.

Although some of the parties in a chain may opt for a completion date 2 weeks after the exchange, there's no 'one-size-fits-all' as some in the chain may be looking for a month - especially if the first-time buyer at the bottom of the chain is in a rental with a 2-month notice.

Choose how long between exchange and completion

We will help you choose how long you should have between exchange and completion and examine the pros and cons for each of the following:

- Exchange and complete on same day

- 3 days between exchange and completion

- 1 to 2 weeks between exchange and completion

- 1 to 3 months between exchange and completion

- Exchange contracts without a completion date (new build/Help to Buy)

Can you exchange and complete on the same day?

Exchange and completion on the same day is an option. It comes with logistical issues, which normally stop it from happening. The biggest problem that stops exchange and completion on the same day is drawing down mortgage funds. Here are the other pros and cons:

Pros | Cons |

|---|---|

Pros

| Cons

|

3 days between exchange and completion

This is a great option for a no-chain and vacant property, often adopted by first-time buyers. In essence, it gets the fastest completion after exchange and has very few downsides other than it may take your mortgage lender more than 3 days to send your solicitor the mortgage funds.

Pros | Cons |

|---|---|

Pros

| Cons

|

What is the best and worst day to complete?

You can complete on any day the seller and the buyer agree on. Most people choose Friday as their completion day to tie in moving in with the weekend, maximising the time to unpack and get their life in order. However, with Friday being in such high demand, you can find the removals cost a lot more than any other day of the week. If you can do so, choosing a Monday or a Tuesday to complete can save on removal costs and your solicitor is less likely to be busy.

Another issue of completing on a Friday is that if you do fail to complete, you have to wait until Monday before you can complete which means the breaching party is covering the other party's costs over the weekend. You can read more about the costs of failing to complete here.

1 to 2 weeks between exchange and completion

This is the ideal time between exchange and completion, giving both seller and buyer time to organise themselves once they know they are legally bound to complete after exchanging contracts. Remember, before exchanging, there are no guarantees either party will complete.

Pros | Cons |

|---|---|

Pros

| Cons

|

1 to 3 months between exchange and completion

This length of time is predominantly requested by first-time buyers looking to tie in their rental notice period with their exchange. The formal notice period for assured tenancy rentals is 2 months. If you are tempted to hand in your rental notice before exchanging contracts, then read this - Made Homeless After Handing Notice to Landlord.

Pros | Cons |

|---|---|

Pros

| Cons

|

Exchange contracts without a completion date

When you buy a new build property, you must exchange contracts within 28 days after reserving it. You are given an estimated time when the property will be built. The final build date can be delayed; however, once the property is signed off as completed by building control, the developers serve notice on you, and you'll need to complete it within 2 weeks.

Pros | Cons |

|---|---|

Pros

| Cons

|

Andrew started his career in 2000 working within conveyancing solicitor firms and grew hands-on knowledge of a wide variety of conveyancing challenges and solutions. After helping in excess of 50,000 clients in his career, he uses all this experience within his article writing for SAM, mainstream media and his self published book How to Buy a House Without Killing Anyone.

Caragh is an excellent writer and copy editor of books, news articles and editorials. She has written extensively for SAM for a variety of conveyancing, survey, property law and mortgage-related articles.

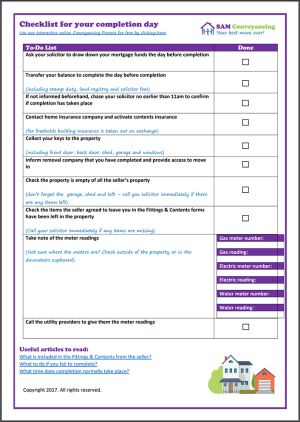

- online checklists

- videos

- free downloads

- useful tips