Exchanging Contracts: A Guide to Legally Binding Your Move

Exchanging contracts is the pivotal moment in the conveyancing process where your property transaction becomes legally binding. Before this point, either party can withdraw without penalty; however, once contracts are exchanged, the buyer and seller are committed to the sale.

Our panel of solicitors ensures all pre-contract enquiries are thoroughly answered, and that your mortgage offer and deposit are fully finalised before the exchange takes place. This guide explains the exact steps required to reach this milestone and what happens if things don't go to plan.

If you've already exchanged, your next milestone will be Completion Day.

Happens when

You exchange

Contracts?

By Andrew Boast, CEO of SAM Conveyancing

What does exchanging contracts mean?

In England and Wales, you are not legally bound to a property transaction until your solicitor exchanges contracts. Until this point, either party can withdraw without penalty.

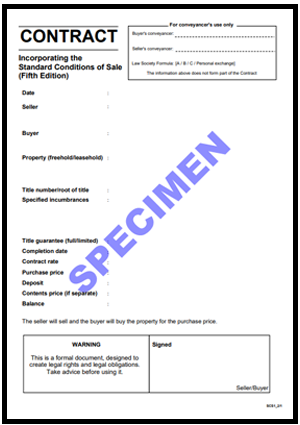

The term 'exchange' refers to the formal process where solicitors confirm the contract details over the phone before posting the signed, dated documents to one another. Once this is finalised, the agreement is legally enforceable.

If you try and stop the process after you exchange, the legal implications and losses are considerable.

How to pay your 10% exchange deposit

Your solicitor will ask you for your exchange deposit when they send you their Report on Title with documents for signing. The process for how you will receive your solicitor's bank details varies, and you must be careful not to be a victim of cybercrime.

Here are some ways solicitors supply their bank details:

- Solicitor App. Most solicitors have an app they use to provide you with their bank details.

- Post. The old-school way is to post you a letter that includes the solicitor's bank account details.

You should never use bank details that were emailed to you, given the high volume of cybercrime via email.

Beware of Cybercrime!

Before transferring your deposit, always verbally confirm the bank details with your solicitor over the phone. Cyber-criminals can intercept emails to change account numbers. Ensure your funds are finalised and sitting in the solicitor's client account at least 24 hours before the intended exchange to avoid delays with banking enquiries.

What if I have paid for a reservation deposit?

The reservation deposit paid to the estate agent or developer is part of the exchange deposit. It is sent on to the seller's solicitor, and for your exchange, you'll need to pay your deposit, less the reservation already paid.

How do solicitors exchange contracts?

This is the step-by-step process a solicitor undertakes to exchange contracts for any property in England and Wales.

- 1

Sign your documents

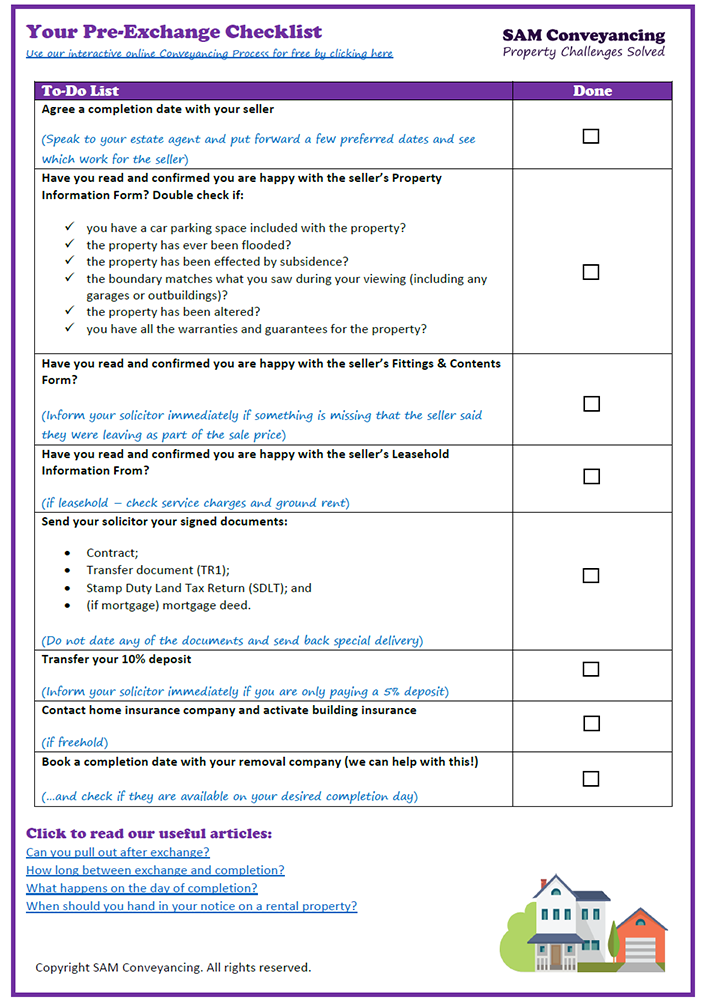

Once all of the legal enquiries are satisfied, your solicitor provides you with:

- Report on Title. This report is drafted by the buyer's solicitor and explains all the details and risks of buying the property.

- Contract. This is the exchange contract you sign; it doesn't need a witness. Don't worry about typos in names or addresses; simply hand-amend them and sign the contract before returning to your solicitor by recorded post.

- TR1 Form. This can be signed digitally or on paper. It must be signed and witnessed by the seller and the buyer. This document is submitted to the Land Registry to transfer title from the seller to the buyer. If you find any errors in this document, send it back to your solicitor. Read more: What is a Land Registry TR1 Form?

- Stamp Duty Land Tax (SDLT) return. Whether you are paying any stamp duty or not, an SDLT form is sent to HMRC to confirm a transaction has taken place.

- Mortgage deed (if applicable). This is provided by the mortgage lender and is signed and witnessed. The mortgage deed is sent to the Land Registry for registration of the mortgage over the property.

The signed documents must be returned to your solicitor by special delivery, to avoid delays. Scan copies are helpful, but originals are required.

- 2

Agree to a completion date

You decide with the seller how long the period between exchange and completion will be. It is more common to have 1 week, but there are pros and cons for longer or shorter completion windows.

- 3

Pay exchange deposit

The standard terms of the contract state, "The buyer is to pay or send a deposit of 10 per cent of the purchase price no later than the date of the contract". Here are things that can affect the amount paid for the exchange of contracts deposit:

- 5% Deposits. With the Government's mortgage guarantee schemes, mortgage lenders are more commonly offering 95% loan-to-value mortgages, allowing buyers to pay a 5% deposit. The contract of exchange is amended to confirm that the buyer is only paying a 5% deposit; however, the buyer remains liable for the balance if they fail to complete after the exchange.

- Sale and Purchase. If you're exchanging in a chain, your buyer transfers their 10% deposit to your solicitor, who will, in turn, send it to your seller. Where the exchange deposit lower down the chain isn't large enough to fund your onward purchase, you'll either have to top up the deposit to 10%, or your seller must agree to accept a lower deposit. The seller often accepts the latter.

- 4

Building Insurance

The buyer is responsible for insuring the building from the day of exchange. You don't have to do this if you are buying a leasehold because the management company/freeholder will already have building insurance. It is advisable to save a quote earlier in the conveyancing process to place it closer to the exchange.

- 5

Give your consent

Your solicitor needs your consent before they exchange. Before you give your consent, here are some things you must check:

- Pre-Exchange Viewing. It may have been a few weeks since you last saw inside the property, so organise a viewing before the exchange.

- Fittings and Contents. Ensure you are happy that what you agreed with the seller is reflected in the seller's Fittings and Contents forms. You could find that the bed you thought was being left as furniture is not included.

- Rental Notice. You'll be handing in your notice on your rental property. But be careful not to do it too early, as you could risk becoming homeless, if the purchase falls through.

- 6

Solicitor gives the release

The solicitors in the chain give a release up and down the chain. This means the solicitor is in a position to exchange and is awaiting release from the other solicitors in the chain.

This can be the frustrating part of the process as you wait to hear when the chain is ready to be exchanged, and it may not happen on the first try. We explain this more below.

- 7

Contracts are exchanged

The seller and buyer's solicitors will call each other and verbally agree on the following parts of the contract:

- property being sold, including the title numbers;

- names of the buyers and sellers;

- deposit being paid;

- completion date; and

- any additional conditions/amendments

Once the checks are complete and the exchange of contracts is complete, both solicitors write the completion date into the contract, sign and date it with a time. From that point, the buyer and seller are contractually bound by the contract, and the solicitors undertake to send each other their clients' signed contracts (hence the name 'exchange of contracts').

Why is exchanging contracts taking so long? Common Delays Explained

Just because you're ready doesn't mean the chain is ready to exchange. It is common for you to have to wait several days before everyone in the chain is ready.

This is a stressful wait, so it'll help to know the reason for this:

Cause for the Delay | What can you do? |

No Signed Documents | A solicitor can't exchange if they don't have their client's signed documents. As these need to be originals, it is likely they are included in the client's post. This could be easily avoided if the buyers and sellers in the chain used Special Delivery. |

No Money | A buyer in the chain may be slow in sending their exchange deposit to their solicitor. As the daily limit for sending money free of charge is £10,000, you should start transferring £10,000 a day to your solicitor so they can hold the deposit before exchanging. |

Enquiries in a Chain | It is very common for one part of the chain to be ready while another is waiting for replies to enquiries. This often happens with the top of the chain, who are buying a freehold, waiting for the bottom of the chain, who are buying a leasehold. You should find out at the earliest opportunity what types of property are in the chain. |

Mortgage Offer | Some enquiries need to be referred to the mortgage lender, even if they have issued a mortgage offer. This can add 5 to 15 working days to the process as the mortgage lender will need to refer the enquiry to the underwriters for their sign-off. |

Expert Tip

An exchange can be delayed because a solicitor is waiting for the original signed documents. If you are close to exchange, ask your solicitor if they'll accept a 'scanned' copy via email to trigger the exchange, provided the hard copy is sent via guaranteed next-day delivery.

By: Andrew Boast, CEO of SAM Conveyancing

What Happens After You Have Exchanged?

Once the exchange is finalised, the legal uncertainty ends, and the countdown to your move begins. Your solicitor will now carry out final Land Registry searches and request the mortgage funds from your lender. For you, the focus shifts from legal enquiries to the practicalities of packing and notifying utility providers.

The period between exchange and completion usually lasts between one and two weeks, though it can happen much faster. Now that your move is legally guaranteed, it is time to prepare for the logistics of the big day.

Your Next Step in the Conveyancing Process:

Preparing for Completion

Andrew started his career in 2000 working within conveyancing solicitor firms and grew hands-on knowledge of a wide variety of conveyancing challenges and solutions. After helping in excess of 50,000 clients in his career, he uses all this experience within his article writing for SAM, mainstream media and his self published book How to Buy a House Without Killing Anyone.

Caragh is an excellent writer and copy editor of books, news articles and editorials. She has written extensively for SAM for a variety of conveyancing, survey, property law and mortgage-related articles.