Lease Extension Disputes: Can a Freeholder Refuse to Extend a Lease?

You've received a Section 45 Counter-Notice from your freeholder, but the premium they're demanding doesn't align with your expectations. Can they simply refuse your lease extension?

Generally, no, the statutory route offers robust protection. However, disagreements on the premium are a common hurdle. This guide provides a clear pathway for leaseholders like you, who've served their Section 42 Notice and are now facing this impasse, outlining your options to reach a resolution and ensure your lease extension progresses.

If you're interested in other ways to extend your lease, you can read about the Informal Lease Extension Process. If your freeholder is difficult to locate, you may need to consider options for an Absentee Freeholder.

What is the statutory process after the Counter Notice is served?

Once your freeholder has served a Section 45 Counter-Notice, the statutory process sets out specific timeframes that are important to be aware of:

- The leaseholder and freeholder have 2 months after the date stated in part 10 of the Section 45 Counter-Notice to negotiate the terms and premium.

- The leaseholder has 6 months after the date stated in part 10 of the Section 45 Counter-Notice to make an application to the Tribunal to determine the terms/premium of the lease extension.

It's crucial to keep these deadlines in mind, as missing them can have implications on your ability to progress your lease extension.

For a broader overview of the timescales involved in the entire process, you can read our article on how long it takes to extend a lease.

You can also read about the expected changes in the Leasehold and Freehold Reform act 2024 which could affect this process in the future.

What to do when you disagree on the premium

After receiving the Section 45 Counter-Notice from your freeholder, it's common to find that they propose a different premium for the lease extension than you anticipated.

This doesn't mean the process has stalled; it simply opens the stage for negotiation. The law provides a framework for you and your freeholder to try and reach an agreement.

The negotiation period - finding common ground

You and your freeholder have a 2-month window from the date of the Section 45 Counter-Notice to negotiate the premium and other terms of the lease extension. During this time, there are a couple of approaches you can take:

- Informal Negotiation: You, or your solicitor, can directly communicate with the freeholder or their representatives to try and find a mutually acceptable figure.

- Surveyor-Led Negotiation: It's often beneficial to instruct a specialist RICS (Royal Institution of Chartered Surveyors) valuer. They can review the freeholder's proposed premium, provide expert advice on the likely statutory valuation, and negotiate on your behalf. Our specialist RICS surveyors have extensive experience in these negotiations and can provide robust representation.

It's important to consider the financial value worth negotiating over. For instance, if the difference between your valuation and the freeholder's counter-offer is relatively small, the cost of further professional fees might outweigh the potential savings. However, a significant disparity often warrants further negotiation, potentially through a surveyor.

- Fixed Fees.

- Leasehold Specialist Solicitors.

- RICS Surveyor Negotiations.

- Complicated jargon made simple.

- Preparation and serving of Section 42 Notice.

When negotiations stall: Taking your case to the First-tier Tribunal (FTT)

Despite best efforts, you and your freeholder might not reach an agreement within the initial 2-month negotiation period.

When this happens, the next step available to the leaseholder to end the disagreement is to apply to the First-tier Tribunal (FTT) (Property Chamber).

You have a further 6 months from the date of the Section 45 Counter-Notice to make this application.

The risk of delay

If you become too focused on lengthy negotiations beyond a reasonable point and miss the 6-month deadline to apply to the FTT, your Section 42 Notice becomes invalid.

To restart the process, you would typically have to wait a further 12 months before serving a new notice, potentially facing a later valuation date and incurring costs anew.

Applying to the First-tier Tribunal (FTT)

Applying to the FTT formally initiates a process where an independent body of experts will determine the fair premium and terms for your lease extension.

To do this, you will need to complete the correct application form (currently available on the GOV.uk website under 'Property Tribunal') and pay the application fee (currently £100, with a potential hearing fee of £200 if a hearing is required). You will also need to submit comprehensive evidence to support your valuation. This typically includes:

- Your Section 42 Notice.

- The freeholder's Section 45 Counter-Notice.

- Any valuation reports you have obtained from RICS surveyors. For example, if your surveyor valued the premium at £15,000 and the freeholder wants £25,000, your report will detail how that £15,000 figure was reached.

- Any correspondence you've had with the freeholder or their representatives regarding the negotiation.

The Tribunal will then consider the evidence from both sides. Often, the threat of Tribunal proceedings can encourage the freeholder to become more realistic in their negotiation to avoid the time and potential costs of a formal hearing.

The prospect of the freeholder incurring their own legal costs for a Tribunal can be a significant motivator for them to find a settlement.

Previous Tribunal Decisions

To get a better understanding of how the First-tier Tribunal approaches lease extension premium valuations and other disputes, you can review past decisions. These are publicly available on the government's website.

Reviewing recent lease extension cases might give you an insight into the factors the Tribunal considers and the typical outcomes.

What is the cost to go to the Tribunal?

Applying to the First-tier Tribunal involves several potential costs for the leaseholder. For a broader view on the expenses involved in extending a lease, you can read our article on Lease Extension Cost. These typically include:

- The Tribunal Application Fee: Currently £100.

- The Tribunal Hearing Fee: If your case proceeds to a full hearing, there is an additional fee of £200.

- Legal Representation (Solicitor/Barrister): While not mandatory, many leaseholders choose to be represented by a solicitor or barrister to prepare their case and present it at a hearing. These costs can vary significantly, with solicitor fees potentially exceeding £1,000+ for preparation and barrister fees ranging from £300 to £500+ per hour (excluding VAT) if they represent you at the Tribunal.

- RICS Surveyor Fees: You may incur further costs if you need your surveyor to provide additional reports or attend the Tribunal.

It's important to note that, unlike in court proceedings for Vesting Orders, the First-tier Tribunal generally does not award costs.

This means that regardless of the outcome, you will likely be responsible for your own legal and surveyor fees, in addition to the Tribunal's application and hearing fees.

- Expert panel of conveyancing solicitors, with local knowledge.

- Fixed, competitive legal fees with no hidden costs.

- We manage the entire process from start to finish.

- Formal or informal lease extensions covered.

- Specialists in Absent Freeholder cases.

- RICS-accredited valuers on hand.

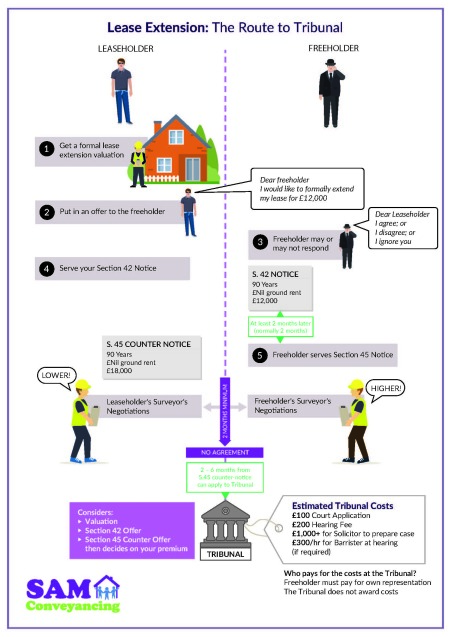

Visualising the route to the First-Tier Tribunal

The following diagram visually summarises the process of applying to the First-tier Tribunal to resolve a lease extension premium dispute:

Andrew started his career in 2000 working within conveyancing solicitor firms and grew hands-on knowledge of a wide variety of conveyancing challenges and solutions. After helping in excess of 50,000 clients in his career, he uses all this experience within his article writing for SAM, mainstream media and his self published book How to Buy a House Without Killing Anyone.

Caragh is an excellent writer and copy editor of books, news articles and editorials. She has written extensively for SAM for a variety of conveyancing, survey, property law and mortgage-related articles.