What is the Capital Gains Tax on Gifted Property?

Capital gains tax on gifted property is payable depending on the relationship or connection between the owner of the property and the party/ies being gifted the property. If there is a connection or a relationship, the capital gains tax will be payable on the full market value.

HMRC will examine the relationship between the seller and the buyer to see how to treat the capital gains tax on gifts, especially if the property is being transferred under market value.

A remortgage will have CGT considerations on a transfer of beneficial interest as well as a legal ownership transfer.

You don't need to pay CGT if:

- You lived in the home the entire time (primary residence).

- You give it to your spouse.

- You put the property into a trust for the benefit of your child (CGT will be deferred until your child sells).

Capital Gains Tax on gift of property to child

The good news is that there is no Capital Gains Tax on your principal place of residence (where you live); there is only CGT on second properties (such as a buy-to-let or a holiday home).

The rules around the gift of property to children are set out here - CG14530 - Consideration for disposal: market value rule.

How can you gift a property to your child?

The most common way to transfer property under market value is often called a Concessionary Purchase.

We specialise in gifting property to children and completing the transaction quickly. Call us for questions, or click the button below to get a Fixed Legal Fee Quote.

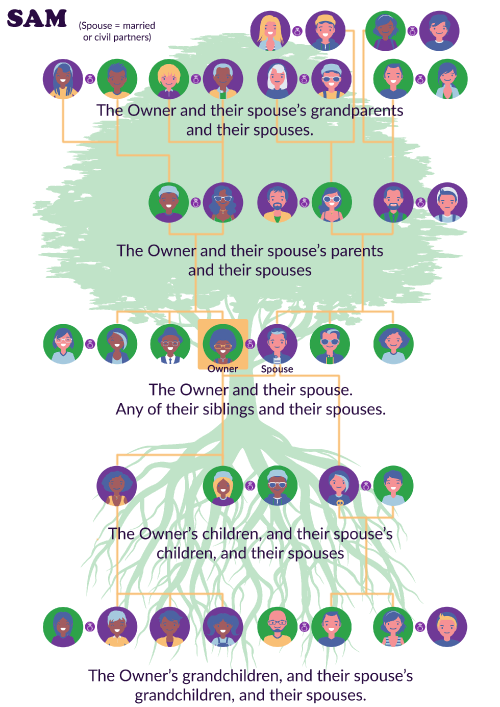

Connected person CGT - a family tree

When a property is gifted to a connected person, the donor will be liable for Capital Gains Tax on the full capital gain, based on the current market value regardless of whether any money was paid for it.

If a donor incurs a capital loss from a gift, this loss cannot be used to offset other capital gains unless the recipient later sells the asset at a profit.

Example:

If you gift a property worth £500,000 to your child (a connected person), and your original purchase price was £200,000, you will be liable for CGT on the £300,000 gain. Even though you haven't sold the property, the gift to your child is treated as a sale at the market value of £500,000.

Your child will then own the property with a base cost of £500,000 (the market value at the time of the gift). If they later sell the property for more than £500,000, they will have to pay CGT on the difference.

Below is an example of a family tree, showing people who are connected to the owner for CGT purposes.

How do you calculate Capital Gains Tax on property?

| | £ |

| Proceeds from the sale of the property at Market Value | i.e £500,000 |

| Take Away | |

| Costs of disposal - eg. estate agent's fee, solicitor's fee , extension/improvement costs | i.e £25,750 |

| Equals = net proceeds of the sale | i.e £474,250 |

| Take Away | |

| Original purchase price of property | i.e £200,000 |

| Costs of original purchase - eg. stamp duty, Land Registry fees, solicitor's fee | i.e £1,500 |

| Gain (or loss) | i.e £272,750 |

| Capital Gains Tax allowance - the annual exemption | (2024-25) £3,000 |

| Amount subject to Capital Gains Tax | i.e £269,750 |

You should speak to a tax advisor for capital gains tax advice.

What is the rate for Capital Gains Tax on gifted property?

| Tax Band | Income Tax Band | Capital Gains Tax Rate (chargeable on profits) |

| Basic rate income tax payer | £0 to £50,270 | 18% |

| Higher rate income tax payer | Over £50,271 | 24% (post 6th March 2024 budget) |

-

Fixed Fee Conveyancing from £399 INC VAT.

-

Fast Completions and Efficient Transfers.

-

Panel of CQS Solicitors on 99% of Lender Panels*.

-

We also offer ID1 Forms - Easy Online ID Verification.

Andrew started his career in 2000 working within conveyancing solicitor firms and grew hands-on knowledge of a wide variety of conveyancing challenges and solutions. After helping in excess of 50,000 clients in his career, he uses all this experience within his article writing for SAM, mainstream media and his self published book How to Buy a House Without Killing Anyone.

Caragh is an excellent writer and copy editor of books, news articles and editorials. She has written extensively for SAM for a variety of conveyancing, survey, property law and mortgage-related articles.