Help to Buy Remortgage Difficulties

Key Takeaways

- You'll want to remortgage when you come to the end of your fixed term, to switch to a better rate than your current lender's standard variable rate, or to release funds to repay some of your equity loan.

- Once you begin paying interest fees on the equity loan portion, your monthly expenses will rise significantly. It can help, however challenging, to remortgage to pay off as much of the loan as possible.

- Any remortgage will require approval from the lender and from Homes England.

- The Help to Buy administrator has now changed; please liaise with Homes England for customer services on your Help to Buy loan.

NB - This article applies to the Help to Buy Equity Loan scheme, and not the Help to Buy Mortgage Guarantee scheme.

Can I remortgage on Help to Buy?

It is possible to remortgage on Help to Buy, but there are additional challenges to overcome. You'll want to remortgage for three reasons:

- After your fixed term ends, the interest rate will switch to your lender's standard variable rate (SVR), which is typically higher than other fixed rate options. Many people choose to remortgage to a more favourable fixed-rate deal to lower their monthly repayments.

- During the first five years after taking out your equity loan, you won't pay any interest. However, starting from the sixth year, you'll begin paying interest; the amount will increase as long as the loan remains unpaid. One option to manage these repayments is to consider remortgaging to pay off some or all of the equity loan.

- Property prices are on the up and therefore the size of the loan increases along with the property value. Remortgaging to pay off the equity loan means you'll get to keep all the equity in the home once you decide to sell up.

Ready to remortgage with Help to Buy?

- Experienced Help to Buy solicitors for remortgaging.

- Nationwide panel of local Help to Buy Compliant RICS Valuers to provide a current market valuation.

- Fixed Fees.

Remortgaging on Help to Buy scheme

The Help to Buy remortgage process is as follows:

Get approval from Homes England and your lender:

- Any new mortgage term agreed with a new lender must not exceed the unexpired term of your existing mortgage. For example, if remortgaging a 25-year mortgage 5 years into the term, the new mortgage should not exceed 20 years.

- The new mortgage must be no more than your existing mortgage from your main lender. The exception to this is if you are going to use the additional borrowing to repay your equity loan.

Send your paperwork to Homes England:

- A copy of the formal mortgage offer from your new lender.

- Details of the solicitor you've instructed to handle the conveyancing for the remortgage.

- A Mortgage Redemption Statement from your current Mortgage Lender.

- A copy of the New Mortgage Lender's Deed of Postponement (DOP).

Pay application fee

Remortgage without repayment: You currently have to pay £115 for this service when you send over the above documents. If you are paying off any of the equity loan at the same time, the fee is £200.

If approved: process complete

Your solicitor processes the required deeds to complete the transaction. You have to inform your new lender of your existing equity loan, which is not only a second charge but entitles the Government to a share of future sale proceeds. You are encouraged to pay off your equity loan as soon as possible.

Help to buy scheme remortgage difficulties

Fixed-rate mortgages are popular, particularly with first-time buyers. These give you a fixed sum you'll have to pay each month and protect against sudden interest rate rises which might otherwise make your monthly payments unaffordable. When your fixed term ends, you must secure another fixed rate to carry on mortgaging under these terms or choose another type of mortgage.

If you can't remortgage for a new fixed-rate deal, your old mortgage becomes chargeable according to your lender's standard variable rate (SVR), which is likely considerably more expensive and less predictable. SVRs are affected by the current base rate set by the Bank of England.

Fixed term periods of 2, 3, and 5 years are common, however, there has been some question over the risks and benefits of fixing your rate.

Book a FREE(i) consultation with one of our independent brokers.

- Access to the whole market.

- Not tied down to selling any particular lender's products.

- 100% impartial advice.

- No need for face-to-face meeting.

What's the catch?

Some lenders might require the equity loan to be paid off before remortgaging with them. Once the initial fixed period expires on your mortgage, you're at the mercy of your lender's standard variable rate and it's likely to be expensive as the lender can get away with charging more.

Why won't lenders grant Help to Buy Equity Loan remortgages?

Lenders have to accept a second charge on the property, i.e. the equity loan portion, repayable to the Government, as well as their first charge (the mortgage). The process set down by the Government for Help to Buy remortgaging, from valuations to paperwork, is much more time-consuming and administratively complex for the lender than normal.

The lender reserves the right to withhold permission to change lenders, from any Help to Buy borrower. Depending on the current interest base rate, lenders might be more reluctant because of affordability concerns when the borrower(s) have two loans to repay (both the mortgage and the equity loan).

This issue is hitting those who used the Help to Buy London scheme hardest because most users will have secured the maximum 40% equity loan available for the region rather than the 20% loan available for the rest of the UK.

Another obstacle is the time limit. Where a lender might grant a regular borrower a larger loan on a new 25-year deal, you will have to repay the additional amount, within the term of the original mortgage, according to Help to Buy's restrictions. A shorter term means larger monthly repayments which may not be affordable.

Homes England does not progress these cases with great speed. If you are waiting for them to come back to your solicitor, you can call and chase them to speed things along.

Securing a Help to Buy remortgage

- It's best to contact your current lender for a new fixed-rate mortgage. The main advantage is that your lender knows you, so the application process should be faster.

- If this approach fails, and given the current small number of lenders offering Help to Buy remortgages, it is highly recommended to seek advice from an independent mortgage broker to discuss your options and likelihood of success. We offer a free initial consultation with a specialist.

- 'Advances to be used for staircasing or repaying the equity loans (sic) will usually be welcomed and approved' - Consider switching your interest rate and obtaining a cash advance from the beginning of your loan application.

- Help to Buy RICS Valuations.

- Remortgaging or selling advice.

- Fixed-fee, no-obligation quotes.

- On 99% of mortgage lender panels.

- Rated 'Excellent' on Trustpilot.

- Solving all your property challenges.

Equity loan interest fee charges: Do they make a difference?

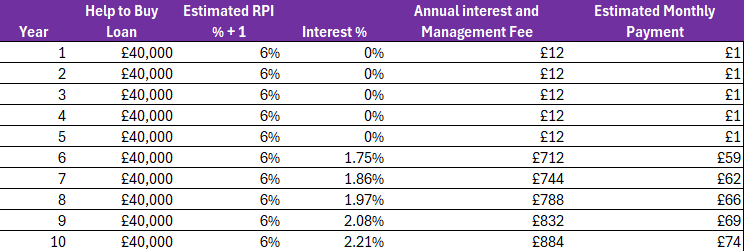

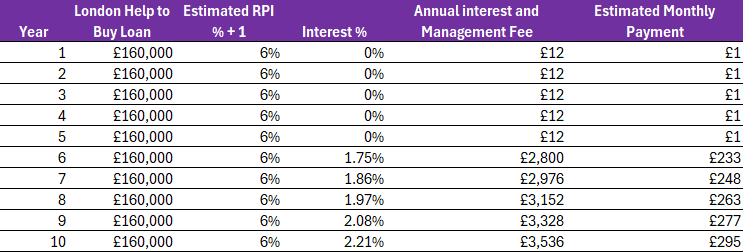

The interest fee structure is designed to encourage you to fully own the property by offering no interest fees for the first 5 years, with only a £1/month management fee.

Given that interest fee payments begin in year 6, it's worth examining the impact of this additional monthly expense alongside main mortgage repayments.

These interest and management fee payments do not contribute towards equity loan repayments. The full debt will still be repayable upon sale.

Interest and management fees on a £40,000 equity loan (non-London)

Interest and management fees on a £160,000 equity loan (London)

Curious about your Help to Buy repayments?

Check out our Help to Buy Repayment Calculator which estimates your monthly interest payments for your equity loan.

Your Help to Buy mortgage payments differ from the Help to Buy equity loan repayments. You can use our calculator to estimate the interest repayments, but we also have a mortgage payments calculator available.

Don't want to remortgage Help to Buy? What else can you do?

Pay off the equity loan with savings or a gift

If you can pay off or reduce your equity loan with cash, either from your savings or through a gift from a family member, you will put yourself in a much stronger position with lenders. This is because you will be reducing or eliminating the second charge on your home.

The longer you don't repay your equity loan, the greater the interest charges. According to the table above, for a London Help to Buy Equity Loan of £160,000, you may have to pay an additional £295 per month to cover the interest and management fees alone.

Sell your property

Your equity loan has to be redeemed in full when you sell up. If the property has increased in value, you'll have an increased equity loan sum to pay off, but you'll have also gained the increase of value in the rest of the property.

Staircasing

There are two ways you can staircase your Help to Buy loan:

- With a lump sum, usually a gift, inheritance, or personal savings.

- With another loan secured against your property. Your solicitor processes the Deed of Postponement document which ensures your mortgage lender is ranked as the first charge on your home. Be wary, though, as borrowing more money secured by a second charge might require mortgage lender consent.

Our experienced conveyancing solicitors can help you staircase your Help to Buy equity loan.

Get a free, no-obligation online quote today from real people, in a real office, based in England. Your property challenges solved.

Andrew started his career in 2000 working within conveyancing solicitor firms and grew hands-on knowledge of a wide variety of conveyancing challenges and solutions. After helping in excess of 50,000 clients in his career, he uses all this experience within his article writing for SAM, mainstream media and his self published book How to Buy a House Without Killing Anyone.

Caragh is an excellent writer and copy editor of books, news articles and editorials. She has written extensively for SAM for a variety of conveyancing, survey, property law and mortgage-related articles.