Title Check Search

What is a title check on property?

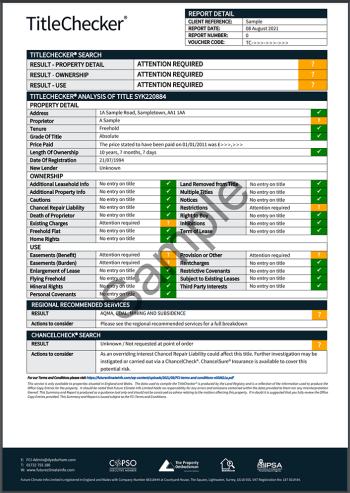

A title check, also known as a title checker conveyancing search allows for a buyer to get a snapshot of a property before they commit to making an offer. It offers information about the ownership, a check if property is freehold or leasehold as well as detailed information about its use and any potential risks.It leaves you to interpret the information yourself and then decide whether the property is worth buying, or if you might put in a lower offer. It can be used for properties in England and Wales.

Key findings in a title checker search

Download Example |  |

How long does a title check take?

The turnaround time for a title check is 2 working hours. This makes it extremely useful, especially if you're buying at auction, as you can get information about the legal on the same day.The TitleChecker inspects the Mortgage Lenders Handbook Parts 1 and 2 so if there is a mortgage lender's charge registered over the title it can confirm what issues will be flagged in the title that'll impact a specific mortgage lender.

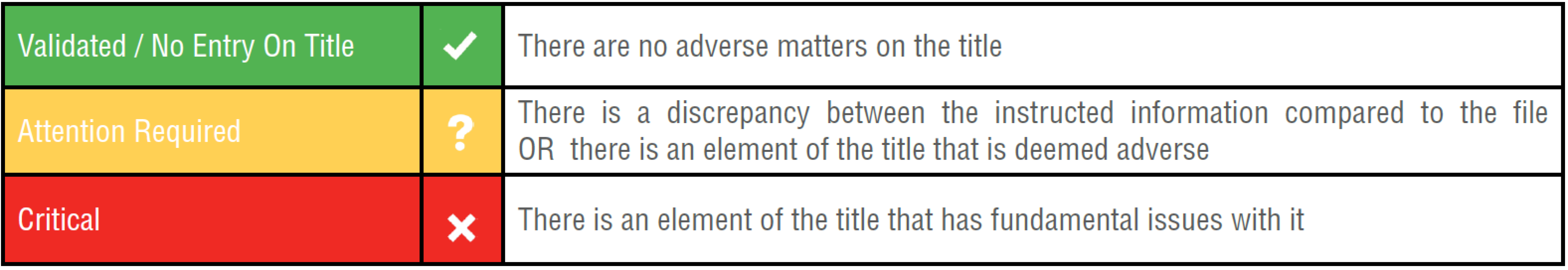

TitleChecker offers a summarised result for each of the above sections, itemised clearly at the top of the report. The overview analysis of each component is listed below. Where the report requires attention or is critical, a more detailed analysis with actions to consider are provided.

What are the Pros and Cons of Title Checker?

Pros | Cons |

|---|---|

Pros

| Cons

|

Does TitleChecker replace the conveyancing solicitor?

While a Title Check Report can provide a snapshot of the legal title, highlighting issues and offering indemnity solutions, it won't replace a conveyancing solicitor during the transaction. A conveyancing solicitor will review the Land Registry Title (often called the title deeds) and not only tell you about the defects but also work toward fixing any issues they find.In the case of a mortgage purchase, you'll also need a conveyancing lawyer to act on behalf of your mortgage lender and to receive and send the money to the seller's solicitor.

What is clear though, is that if you quickly want some great inside knowledge about the property you are buying, should you be buying at auction, for example, then a Title Checker Search can help.

Title Checker Search | Pre-Auction Report |

|---|---|

Title Checker Search Short on time? Get a report that inspects the property title today.

£66 INC VAT Sent normally within hours of instruction | Pre-Auction Report Need a solicitor to do the legal work for you?

INC VAT for freeholds or INC VAT for leasehold |

Andrew started his career in 2000 working within conveyancing solicitor firms and grew hands-on knowledge of a wide variety of conveyancing challenges and solutions. After helping in excess of 50,000 clients in his career, he uses all this experience within his article writing for SAM, mainstream media and his self published book How to Buy a House Without Killing Anyone.

Caragh is an excellent writer and copy editor of books, news articles and editorials. She has written extensively for SAM for a variety of conveyancing, survey, property law and mortgage-related articles.