Memorandum of Staircasing

The memorandum of staircasing represents a critical stage in the shared ownership staircasing process and comes just before you finalise your funding for the staircasing and move to completion of the process.

In this article, we explain the memorandum of staircasing in relation to the staircasing process.

What is the memorandum of staircasing form?

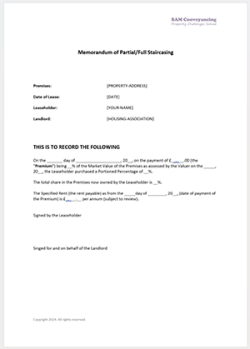

A Memorandum of Staircasing is a document issued by your housing association which confirms the amount you need to pay to buy more shares in your property. It is dated, as it's impacted by the current market value of your property and needs to be signed and returned to them.

The memorandum of staircasing form consists of the following:

- Premises address

- Date of lease

- Leaseholder name

- Landlord name (housing association name)

- Amount of payment for staircasing (the staircasing premium)

- Date paid over

- What extra percentage of the whole property the premium buys

- The total share the leaseholder holds after payment (percentage of whole property)

- The specified rent

- Signatures of both leaseholder and landlord

How to get memorandum of staircasing

- 1

Housing associations have different procedures for the staircasing process, but you'll normally start by applying directly to them. This is usually done through a form you send back to them - and paying any requisite fee.

You'll have to state the percentage you wish to staircase to and how you intend to pay for it. If you're staircasing below 100%, it's called partial staircasing and f you're staircasing to 100%, it's known as full staircasing.

Make sure you've paid off any arrears before you apply!

Your housing association won't let you staircase unless you've paid off any outstanding debt you owe them, whether this is for rent, service charges or major works fund.

Your housing association replies, informing you that you need a RICS valuation and you'll need to instruct a solicitor and send on the details of both back to them.

You should be able to choose your own RICS valuer, but some housing associations will ask you to pick from a list of approved valuers. You'll have to give details of any improvements you've made to your valuer, so they can work out two current market valuations - one with the improvements and the other not including the improvements. If you've gotten permission from the housing association for those improvements, they will count towards the current market value. If not, the value the housing association uses is the one without any improvements.

Once you've received the valuation report you send this back to your housing association.

Depending on the housing association and how you've stated that you'll pay for the staircasing, the association might well also ask you to provide further details as part of a financial assessment that you can actually pay for your staircasing.

Once you instruct your solicitor, they will first ask for proof of ID and address from you. After that, they'll need to check how you're getting your funding for the staircasing. If you're paying with cash or savings, you'll have to provide bank statements, and if you're getting a remortgage, your solicitor contacts the lender as they'll be acting for the interests of the lender as well.

The housing association appoints their own solicitor, and they will contact yours according to the details you've given. They will request a number of documents like ID checks, scrutiny/due diligence of any savings you're intending to pay for the staircasing with and/or details of the mortgage lender.

Once your solicitor has returned these items to them, the housing association's solicitor then drafts the memorandum and sends it to your solicitor.

What is the final staircasing process?

The housing association's solicitor sends the draft memorandum of staircasing to your solicitor for approval, and your solicitor sends you a copy to sign. This is then sent back to the housing association for them to sign as well.

Your solicitor should provide you with a copy of the doubly-signed memorandum.

If you are paying for your staircasing with cash and your solicitor is satisfied with the source of your funds, then you progress to the final staircasing step - completion.

If you remortgage to pay for your staircase, you need to get the staircasing mortgage offer before you can complete.

Once your funds are in place, your solicitor proposes a completion date on your behalf and the housing association has to confirm it. After this, you progress to staircasing completion.

Your solicitor should also register the memorandum of staircasing with the Land Registry and confirm with you that this has been done.

Is staircasing registered at the Land Registry?

There is no legal reason to register the memorandum with the Land Registry, but you are advised to ensure that this is done. A missing or lost memorandum might create complications if the staircasing wasn't registered.

It's best to do it to avoid problems when it comes to selling up or having to prove your increased ownership for other purposes. Ultimately the 'audit trail' (solicitor, housing association, mortgage lender) would prove that you had done so.

How do I register a Memorandum of final staircasing?

Your solicitor should do this on your behalf. You are always advised to staple your copy of the memorandum of staircasing to your lease, which provides proof of your increased ownership.

The cost to register the memorandum of staircasing at the Land Registry varies between £20 - £140 depending on the value of your property. We include this in our fixed fee quote.

Land Registry Scale TWO Fees

| Value of Property (£) | Fee - Electronic | Fee - Postal (New Builds or First Registration) |

| 0 - £80,000 | £20 | £45 |

| £80,001 - £100,000 | £20 | £45 |

| £100,001 - £200,000 | £30 | £70 |

| £200,001 - £500,000 | £45 | £100 |

| £500,001 - £1,000,000 | £65 | £145 |

| £1,000,001 and over | £140 | £305 |

Need a Staircasing Shared Ownership Solicitor?

Our experienced shared ownership conveyancing solicitors can help you complete within the tight timeframes involved with staircasing. Call us on 0333 344 3234 (local call rate) or get an online quote below.

Andrew started his career in 2000 working within conveyancing solicitor firms and grew hands-on knowledge of a wide variety of conveyancing challenges and solutions. After helping in excess of 50,000 clients in his career, he uses all this experience within his article writing for SAM, mainstream media and his self published book How to Buy a House Without Killing Anyone.

Caragh is an excellent writer and copy editor of books, news articles and editorials. She has written extensively for SAM for a variety of conveyancing, survey, property law and mortgage-related articles.