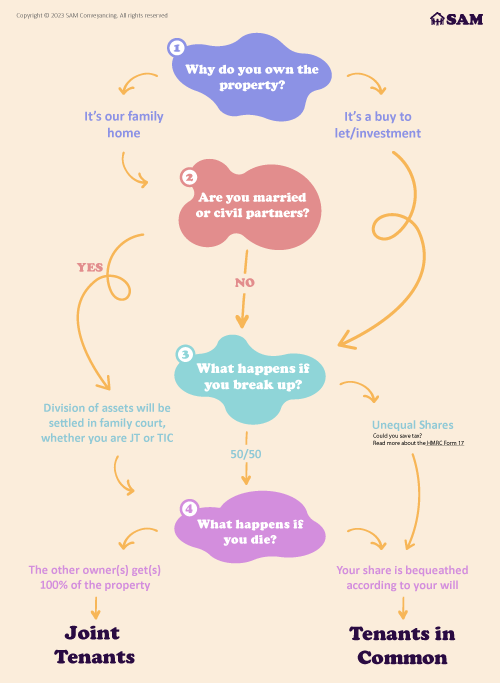

Joint Tenants vs Tenants in Common

Are you buying a property with someone else? Choosing how you own it – as joint tenants or tenants in common – is one of the most important decisions you'll make.

It impacts everything from what happens if one of you dies to how you'd divide the proceeds if you split up. Get this wrong, and you could face legal battles and financial hardship.

While joint tenancy offers simplicity, it is only truly suitable for married couples. Any other relationship type will benefit more from a tenancy in common ownership structure which provides more flexibility and protection but requires careful planning.

What happens if your relationship breaks down and you want out? It's possible to change from joint tenants to tenants in common, so if you're already joint tenants, don't worry, we can help you serve a Notice of Severance.

Differences Between Joint Tenants and Tenants in Common

Form JO at the Land Registry clarifies how joint owners will hold property (Joint Tenants, Tenants in Common 50/50, or Tenants in Common in unequal shares).

Joint Tenants

- As joint tenants, you have equal rights to the whole property (undivided share in land).

- The property automatically goes to the other owner if one of the joint tenants dies.

- You can't pass property ownership onto the beneficiaries in your will if you were married. Your surviving partner would be able to transfer the share to the beneficiaries.

- It is harder to force a sale, and you may need to sever the joint tenancy.

Tenants in Common

- As tenants in common, you can own different beneficial shares of the property (for example 50/50 or 99/1).

- The property doesn't automatically transfer to the other joint owner if you die.

- You can transfer your share of the property to anyone in your will.

- It is easier to force a sale or sell your share.

The legal definitions of joint tenants and tenants in common, and how property ownership is split, are stated here: Law of Property Act 1925.

Call us at 0333 344 3234 or request a callback/email to answer your queries about our Land Registry application services. SAM's UK-based team will explain which of our solicitor services are required to make changes to the title.

There's no obligation to instruct. We'll make sure you understand your options and provide a free, fixed-fee quote for our best-value service to meet your needs. No robots, no call centres. Property challenges solved.

How to change your ownership: Joint Tenancy vs Tenants in Common

Tenants in Common to Joint Tenants

Unmarried couples who go on to marry may want to change how they own their property to reflect their new legal status. This simplifies inheritance and ensures the property automatically passes to the surviving spouse, avoiding the need for probate on death.

The change in ownership is reflected by removing the Form A restriction with Form RX3, providing an accompanying Deed of Surrender to confirm each owner understands the beneficial interest split, and cancelling the original statement of truth with Form ST5 at the Land Registry.

Our fee for this service starts from £535.

Joint Tenants to Tenants in Common

Couples who divorce or separate may want to change from Joint Tenants to Tenants in Common. This allows each person to own a specific share of the property, which they can then leave to someone other than their former partner in their will.

It also offers more flexibility in dealing with the property, as it doesn't automatically go to the other owner upon death. Similarly, couples who own a buy-to-let property as joint tenants might decide to switch to tenants in common to manage income and tax implications more effectively.

The ownership structure change is submitted to the Land Registry with a Form A restriction and can be done through a Notice of Severance or a Deed of Assignment. Our fee for this service starts from £535.

How a solicitor helps: A solicitor can prepare all the necessary legal documents (Deed of Severance, Notice of Severance, Deed of Trust), ensure they are correctly executed, and handle the registration process with the Land Registry, giving you peace of mind that the change is legally sound.

Tenants in Common vs Joint Tenants: How do you choose?

What happens if you die?

Married couples mostly share their main residence as joint tenants to allow the property to go directly to their joint owner when they die.

Joint tenancy isn't suitable for unmarried couples, because upon death the deceased party may wish their property to go to their family or, if there are children, to their children. It is also worth considering what happens if you break up.

Is this an investment?

Married couples can often own investment properties as buy-to-lets because they might have lived in it before buying their new residence, choosing not to sell it and use it as an investment instead.

If the property is an investment, then you need to consider if owning it as joint tenants is tax-efficient for you. Having an exact 50:50 beneficial share is rarely tax-efficient.

What if you broke up?

Unmarried couples would want the flexibility to sell the property if they break up, get their money out and move on with their lives separately. The challenge arises if one of the joint owners doesn't want to sell but can't afford to buy you out.

You can force a sale but this is costly and your success rate depends on your intentions for the property when you first purchased it.

SAM's 'best fit' image

What are the Pros and Cons of Joint Tenants?

The surviving joint tenant owns 100% of the property

If tenants in common, the deceased's Estate would look to sell the property to release the equity due to the estate.

Simple beneficial ownership

Joint tenants own the property 100%, so they share income equally 50/50.

Costs less in legal fees

Solicitors charge more for drafting a Deed of Trust and registering the restriction.

No need to declare a From 17

Any rental income from the property is shared 50/50 so there's no need to declare to HMRC.

Risk in relationship breakdown

Joint tenants own the property 100%, in one indivisible share, so if one party pays more than the other to buy the property, this is not recognised and any gain or loss is shared equally.

No Deed of Trust

You cannot have a Deed of Trust when buying as joint tenants.

Harder to force a sale

If you live in the property as joint tenants, you will struggle to sell the property without mutual consent, forcing you to go to court to seek a court order.

How do I confirm my type of ownership?

You declare your ownership type in the TR1 deed (Transfer of Whole of Registered Title) when buying the property. This legal document specifies whether you are purchasing as Joint Tenants or Tenants in Common.

If you already own the property and want to change the ownership structure or add someone to the title, you will also use a TR1 form or other relevant Land Registry forms such as an AP1 (Application to change the register). It's crucial to ensure the TR1 (or other relevant form) accurately reflects your intentions, as it forms the basis of your legal ownership.

How a solicitor helps: A solicitor can guide you through the process of completing the TR1 (or other relevant forms) and ensure it aligns with your wishes. They will also handle the submission and registration of the form with the Land Registry, ensuring the changes are officially recorded.

What are the Pros and Cons of Tenants in Common?

Your beneficial interest is separate and can be unequal

You own your own individual share of the property that belongs to you. It is advisable to draft a Deed of Trust to confirm what this share is.

Reduced risk in relationship breakdowns

If joint owners have a Deed of Trust, the risks are reduced if the relationship breaks down. As joint tenants, you can't create a Deed of Trust. With a deed, you can include beneficial interest shares and what happens if either party wants to sell.

Easier to force a sale

If you have a Deed of Trust with an exit clause, it is easier to sell the property if one party doesn't want to sell.

Your share goes to your Estate on death

When you die, your share of the beneficial interest in the property passes to the beneficiaries named in your will and not the joint owner of the property.

Draft a Deed of Trust

A Deed of Trust details the beneficial interest shared between the joint owners. A basic Deed of Trust costs £240 INC VAT and we can draft this for you.

Draft a will

Your share of your property goes to your beneficiaries upon death and not to the other joint owner. If you don't have a will then you die intestate. A basic will costs £180 INC VAT and we can draft this for you.

Declare a From 17

If you are married and own the property as tenants in common in unequal shares, any rental income from the property is shared 50/50 and as such there is no need to declare to HMRC.

Do you need a Deed of Trust for separate beneficial shares?

Whether you buy as Joint Tenants vs Tenants in Common, you need to think through how you want to live together with your joint owner.

If you are buying as tenants in common, then you are best advised to draft a Deed of Trust to set out the intentions between the beneficial joint tenants. We offer different types of deeds including:

- Basic Deed of Trust - Aimed at married couples, long-term relationships and family members looking to declare the individual beneficial interest and confirm an exit strategy for when either party wants to sell.

- Buy to Let Deed of Trust - Aimed at joint owners looking to share property income in a tax-efficient way, to be filed alongside a Form 17 declaration to HMRC if you are married and tenants in common.

- Foating Deed of Trust - Aimed at unmarried couples and friends and includes a more complex formula to calculate the beneficial interest over the life of the investment, taking into account mortgage repayments, costs of purchase/sale and developments.

Protect your interest in a property and confirm how to sell. Drafted by a solicitor.

The first draft is within 1 to 2 working days* and includes:

- Deposit paid.

- The percentage ownership of each party.

- How to share expenses like the mortgage and bills.

- Share of property income - rent or gain on sale.

- How to sell the property.

- How the property is divided in the event of separation, divorce, or death.

Andrew started his career in 2000 working within conveyancing solicitor firms and grew hands-on knowledge of a wide variety of conveyancing challenges and solutions. After helping in excess of 50,000 clients in his career, he uses all this experience within his article writing for SAM, mainstream media and his self published book How to Buy a House Without Killing Anyone.

Caragh is an excellent writer and copy editor of books, news articles and editorials. She has written extensively for SAM for a variety of conveyancing, survey, property law and mortgage-related articles.