Key Takeaways

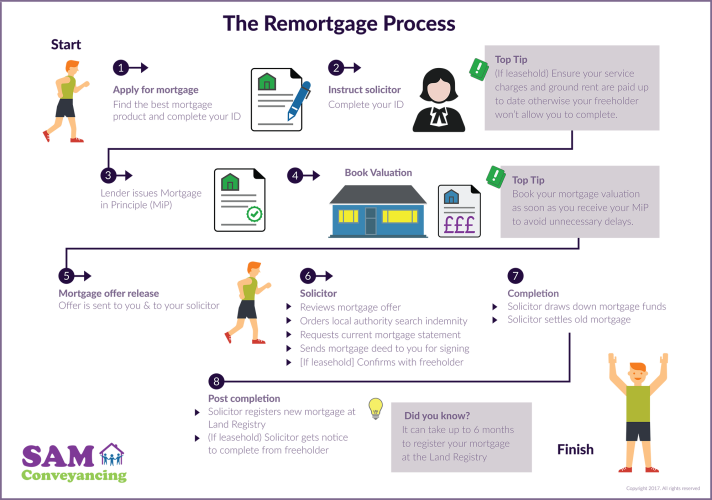

- Before starting the remortgage process, you will need to instruct a solicitor. They will perform all the necessary checks, review your new mortgage offer and update the Land Registry post-completion.

- The remortgage process is similar to when you purchase, but it should generally take less time, as the solicitor doesn't need to raise any legal enquiries.

- If you own a leasehold property, your solicitor will have to carry out extra work in order to investigate the lease terms.

There are many different reasons why you might need to remortgage your home. It may be to free up equity for an extension or to settle a second charge on the property. It could even be to simply secure a better mortgage interest rate. The majority of remortgages take place close to the end of the fixed beneficial interest rate.

What is the remortgage conveyancing process?

- Find a solicitor, ID and title checks

- Mortgage offer and request current mortgage statement

- Completion

- Update Land Registry Post Completion

The remortgage conveyancing process is faster than when you purchased the property, with the key objective being to satisfy the requests of your new mortgage lender. Unlike on the purchase, the solicitor does not raise legal enquiries to investigate the legal title (this would have been done when you purchased the property).

However, they do look for restrictions and charges that could affect their ability to register the property with the new mortgage interest. This article explains exactly what happens during the conveyancing for your remortgage.

1 What checks are done for remortgage?

ID Check

Your solicitor will need to prove who you are through their ID checks. Our solicitors do this using 1 form of photo ID and 2 forms to prove your address; both are then checked through an online checking system which costs £8 per name. We discuss this further in our article -

'What ID does my conveyancing solicitor need?'.

If you are remortgaging for a lower amount and looking to pay off some of your mortgage, then your solicitor will need to confirm the source of the funds you are using to pay off the mortgage. You can read more on this in our article -

How to prove source of funds?

Charges and restrictions

You solicitor will then request a copy of your title deeds to confirm if:

- there are any charges or restrictions on the title that need satisfying

- you are the legal owner of the property

Leasehold terms

If the property you are remortgaging is a

leasehold, then the solicitor reviews the covenants in the lease, to confirm who they have to serve notice on, to confirm the change from charges (mortgages or loans) to post-completion. The solicitor will also confirm the leasehold title is compliant in accordance with the

Council for Mortgage Lenders (CML) Handbook.

2 What happens after remortgage offer is issued?

Your mortgage lender issues their mortgage offer to your solicitor. Different mortgage lenders will have different requirements for their solicitor to adhere to. Whereas some won't ask the solicitor to do anything more than their obligations under the CML, some mortgage lenders request additional information to be provided to them before they will agree to funding the proposed mortgage.

For example, Paragon Mortgages requires the solicitor to provide copies of planning permission, building regulations and rights of way, however, Santander PLC doesn't require this.

If there is an existing charge registered on the property, then the solicitor requests for the mortgage lender to provide a current mortgage statement in order to discharge the balance on completion.

Different mortgage lenders have different criteria with regards to the

local authority search. Some mortgage lenders are happy for you to take out local authority search indemnity insurance, some will not and expect you to obtain either an official local authority search or a personal regulated local authority search. We discuss the difference between the two in our article -

Official vs Personal Local Authority Search.

Discounted Bundle of Searches

Order the most common searches required for purchasing a property at a discounted price.

Chancel Search

Drainage & Water

Climate Risk Report

Environmental Report

Regulated Local Authority

£89 INC VAT

ETA dependant on Local Authority

Order Search

£106 INC VAT

Delivered in: 10-14 days

Order Search

£149 INC VAT

ETA dependant on Local Authority

Order Search

£72 INC VAT

Delivered in: 2 hours*

£215 INC VAT

Delivered in: 1-8 weeks

Order Search

The solicitor will take out an OS1 priority search to freeze the title of the property from being able to have any changes applied to it and then complete a bankruptcy search on you. The OS1 costs £3 per title and the bankruptcy search costs £2 per legal owner searched.

Once your solicitor is satisfied that the title is satisfactory for the purposes of the mortgage lender, that you have sufficient funding to redeem the current charge on the property and that you have passed their due diligence, then the solicitor will agree with you a date to complete. They will then send off the certificate of title to the mortgage lender requesting the release of the mortgage funds in time for completion.

The solicitor sends you a financial statement before completion detailing the balance required to complete or due to you. This is an example of a freehold remortgage conveyancing costs for a property valued at £250,000:

|

Mortgage advance from new lender | £250,000 |

Less |

Mortgage to redeem | £250,000 |

Remortgage legal fees | £323 INC VAT |

Remortgage Land Registry fee | £40 |

Local Authority Search Indemnity Insurance | £45 |

Online ID check | £8 |

Official Copy and title plan | £6 |

OS1 & Bankruptcy | £10 |

|

Balance to be paid to complete remortgage | £432** |

Once your mortgage advance is received in from your new mortgage lender and you and your solicitor are ready to complete, then your solicitor will redeem your existing mortgage, settle their invoice and any disbursements (online ID check, official copy costs and OS1/bankruptcy). The balance, if any, is then repaid to you. The only amounts left will relate to the Land Registry fees and any costs due to the property being a leasehold.

The process for discharging the old mortgage and registering the new mortgage at the Land Registry can take between 1 to 6 months after completion. The time delay is linked to the Land Registry having a backlog of work. This can be extended further for leasehold properties if the freeholder/managing agent delays in releasing the notice.

Delays can be worsened if your service charge and/or ground rent are in arrears so make sure that you have settled these prior to remortgaging otherwise you may have a stand-off with your freeholder not releasing your notice until your service charge account is settled (read more about

What happens after completion).

How long does conveyancing take on a remortgage?

A remortgage can take a matter of weeks to complete once you have a mortgage offer. The delay normally relates to the time it takes to get your mortgage offer (remember a mortgage in principle isn't a mortgage offer and you'll still need to get a mortgage valuation).There can also be delays with the freeholders providing notice after completion, especially if you haven't paid your service charges and ground rent.

Access to whole of the market | 100% Impartial advice | No need for face-to-face meeting